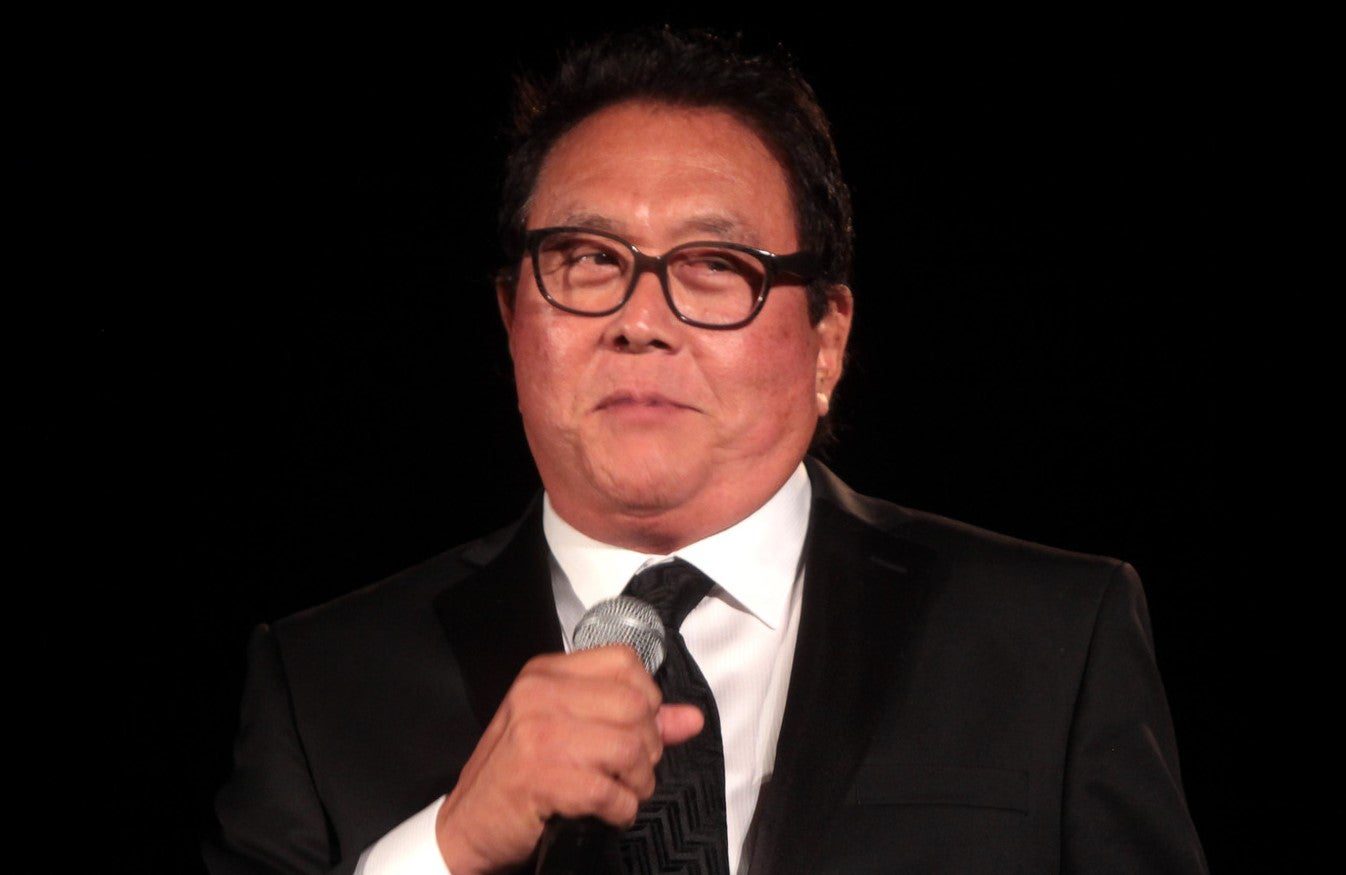

On a recent episode of “The Rich Dad Radio Show,” renowned financial educator Robert Kiyosaki voiced serious concerns about the United States’ financial status, starkly stating, “America is now bankrupt.” This bold assertion, while not reflecting a legal reality, highlights the daunting state of the U.S. national debt, which stood at a staggering $33.8 trillion as of November 24.

Jim Clark, CEO of Republic Monetary Exchange and a guest on the show, pointed out that when including entitlements, the actual financial liabilities could skyrocket to around $200 trillion. The fiscal year 2023 witnessed a 39% surge in interest payments on this debt to $659 billion, nearly doubling the figure from fiscal 2020.

In response to these economic challenges, Kiyosaki, famous for his advocacy of financial education, leans heavily towards tangible assets for wealth protection. Here’s a look at two of his preferred investment avenues:

Gold and Silver as Inflation Hedges

Kiyosaki traces the root of America’s fiscal woes back to the abandonment of the gold standard in 1971. He regards gold and silver as critical hedges against inflation and currency devaluation. The increasing industrial demand for silver, coupled with the relatively low current prices of these precious metals compared to their historical peaks, makes them appealing investments in his view. An added advantage, according to Kiyosaki, is the absence of counterparty risks with physical gold and silver, unlike many other investment types.

Real Estate: A Robust Inflation Shield

Besides precious metals, Kiyosaki heavily invests in real estate, claiming ownership of 15,000 houses. He considers real estate a powerful shield against inflation, a view supported by data from the Federal Reserve Bank of St. Louis. Since 1963, while the consumer price index has soared by 896%, the median home sales price and rent have jumped by 2,353.93% and 892%, respectively. This trend indicates that real estate not only tracks inflation closely but often surpasses it in growth.

Kiyosaki’s strategy resonates with the concept of fractional real estate investing, which opens doors for average investors to own shares in income-producing properties. Starting with investments as low as $100, this approach allows individuals to reap the benefits of rental income and property appreciation, bypassing traditional investment hurdles like high costs and stringent credit requirements.

Kiyosaki’s methods offer a window into how investors might safeguard their assets amid economic turbulence. However, it’s crucial to remember that his strategies may not universally apply. Investors are advised to conduct thorough research and seek guidance from financial professionals before making any investment decisions.