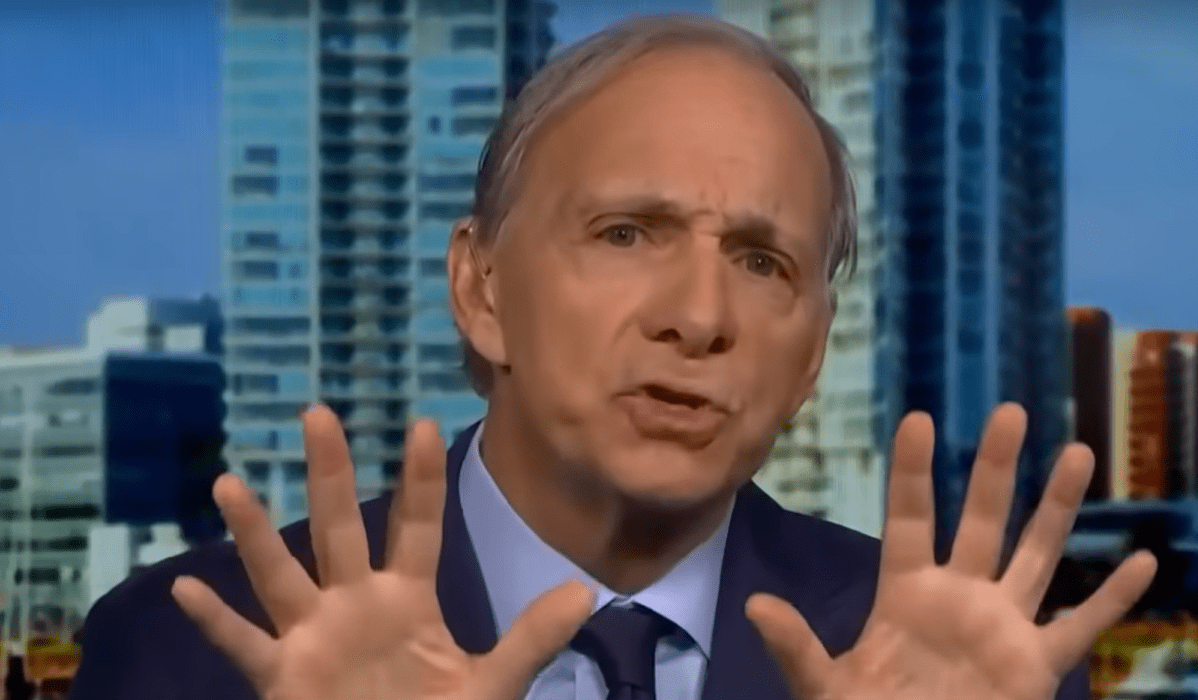

In a sobering assessment of America’s fiscal situation, billionaire Ray Dalio, the founder of Bridgewater Associates, the world’s largest hedge fund, has raised concerns over the rapidly escalating national debt, which is nearing a staggering $33.74 trillion. Speaking to CNBC, Dalio highlighted a troubling cycle in the U.S. economy: the country is increasingly borrowing money just to service its existing debt.

Dalio explained that when a nation’s debt grows faster than its income, the costs of servicing that debt begin to encroach upon its spending. To maintain current spending levels, the country is then compelled to accrue more debt, creating a self-perpetuating cycle of increasing indebtedness. “The way that works, it accelerates,” he cautioned.

Complicating matters further are America’s internal political dynamics and social conflicts. Dalio’s warning echoes concerns raised by Moody’s Investors Service, which recently downgraded the U.S.’s ratings outlook from “stable” to “negative.” Moody’s cited “continued political polarization” as a factor that could impede lawmakers’ ability to reach a consensus on a fiscal strategy to manage the nation’s declining debt affordability.

The conversation also turned to the future of interest rates, a critical issue for a country grappling with such a massive debt load. Since the U.S. Federal Reserve began hiking rates in March 2022, the burden of higher monthly payments has become increasingly palpable. Dalio, however, doesn’t foresee significant shifts in Fed policy in the near term, aside from a potential slight easing if the economy slows down.

Despite these pressures, recent economic data suggests a resilient U.S. economy. The Commerce Department reported a 4.9% annual increase in real GDP for Q3, surpassing economists’ predictions and marking the largest surge since Q4 of 2021. Yet, Dalio remains concerned about the nation’s financial strength, questioning whether the U.S. can maintain a positive income statement and a healthy balance sheet. “We are near that inflection point,” he concluded, signaling a critical juncture in the country’s fiscal health.

Image source: CNBC on Youtube