[tdc_zone type=”tdc_content” tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImRpc3BsYXkiOiIifX0=”][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column_text]

Advertiser Disclosure: This article contains references to products from our partners. We may receive compensation when you click on links to those products. Our content is written objectively and is intended to provide informative and helpful information to our readers. Our goal is to help you make informed financial decisions, but our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column_text]

How to Earn Monthly Rental Income While You Sleep (Without Becoming a Landlord)

[/vc_column_text][vc_column_text]

Collect passive income from real estate without taking on the headaches of being a landlord. You can buy shares of rental properties with as little as $100 thanks to this investment platform backed by Jeff Bezos.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9LCJwaG9uZSI6eyJkaXNwbGF5IjoiIn0sInBob25lX21heF93aWR0aCI6NzY3fQ==” column_height=”eyJwaG9uZSI6IjEifQ==”][vc_single_image media_size_image_height=”225″ media_size_image_width=”300″ size=”contain” tdc_css=”eyJwaG9uZSI6eyJiYWNrZ3JvdW5kLXN0eWxlIjoiY29udGFpbiIsImRpc3BsYXkiOiIifSwicGhvbmVfbWF4X3dpZHRoIjo3Njd9″ height=”eyJwaG9uZSI6IjIwMCIsImFsbCI6IjU1MCIsInBvcnRyYWl0IjoiNDAwIn0=” image=”23345″][/vc_column][/vc_row][vc_row tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==” content=”

Investment Disclaimer: Seek Professional Advice

Please Note: This article is for informational purposes only and does not constitute financial or investment advice. The views, thoughts, and opinions expressed in this article belong solely to the author and are not intended as a specific guide to investing.

Investing in real estate and financial markets involves a risk of loss, and each individual’s investment strategy may vary based on personal circumstances and financial goals. The real estate market’s dynamics and predictions mentioned in this article are based on current market trends and are subject to change.

We strongly recommend consulting with a licensed financial advisor or a certified investment professional before making any investment decisions. A professional advisor can provide personalized financial advice based on your individual situation, help you understand the risks and potential rewards of various investment opportunities, and guide you in aligning your investment choices with your financial goals and risk tolerance.

By reading this article, you acknowledge that the authors, publishers, and Arrived Homes are not responsible for any personal financial decisions or outcomes resulting from your investment actions.

“][vc_column_text border_top=”no_border_top”]

Real estate has long been a cornerstone of wealth generation, and as 19th-century British philosopher and economist John Stuart Mill once said, “Landlords grow rich in their sleep.” However, being a landlord isn’t always as passive as it seems. From screening tenants and preparing lease agreements to handling maintenance and chasing rent payments, managing a rental property can be a time-consuming and stressful endeavor.

Fortunately, there are ways to earn monthly rental income without the hassles of being a landlord. One popular option is investing in real estate investment trusts (REITs), which are essentially giant landlords that own income-producing real estate and collect rent from tenants. REITs are required by law to distribute at least 90% of their taxable income to shareholders as dividends, making them an attractive choice for investors seeking passive income.

The iREIT® – MarketVector Quality REIT Index ETF (NYSE: IRET), also known as The Intelligent REIT ETF, is a compelling option for investors looking to diversify across multiple quality REITs. Launched on March 5, 2024, this ETF provides exposure to common and preferred shares of 40 U.S.-listed REITs, all selected using fundamental research data screened for both quality and value.

Investing in a REIT ETF like IRET allows you to gain exposure to a diverse portfolio of real estate assets across various sectors, such as residential, commercial, and industrial properties. This diversification can help mitigate risk while providing a steady stream of passive income through regular dividend payments.

However, it’s important to note that ETFs like IRET come with their own set of risks. The value of the underlying REITs can fluctuate, affecting the ETF’s performance and yield. Additionally, while the ETF aims to provide monthly income, dividends are not guaranteed and can vary.

A More Direct Approach

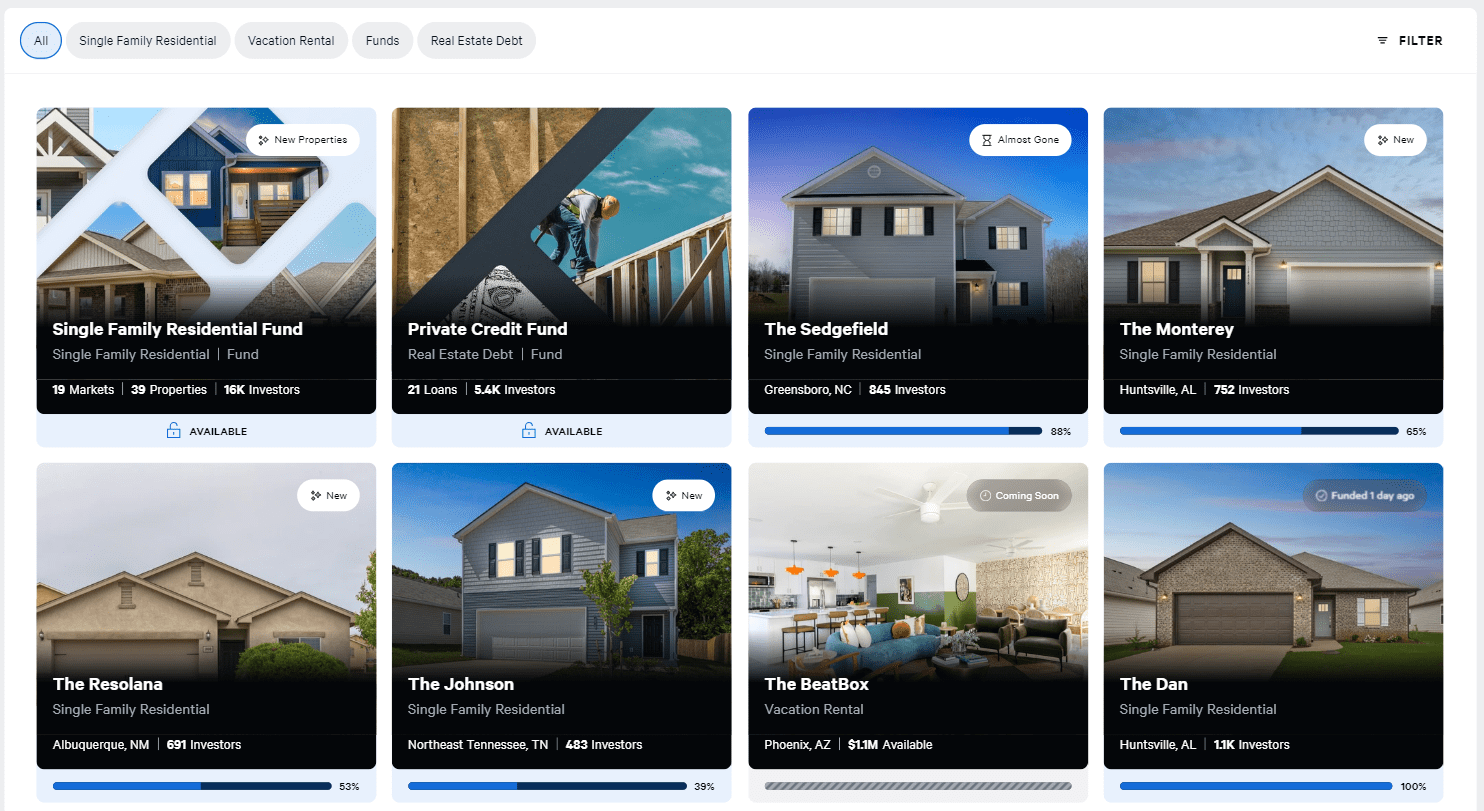

For investors looking to take a more hands-on approach to real estate investing without the full responsibilities of being a landlord, Arrived presents an intriguing alternative. This platform, backed by Amazon founder Jeff Bezos, allows individuals to invest in shares of specific rental properties for as little as $100.

Arrived gives investors more control than traditional REITs or REIT ETFs by enabling them to choose the specific properties they want to invest in. Investors can browse through available properties on the platform, review details about each property’s location, tenant and expected returns, and then decide which properties best fit their investment goals.

Arrived handles all the property management responsibilities, including finding tenants, collecting rent and handling maintenance, while investors sit back and collect their share of the rental income and any appreciation in the property’s value. With regular payouts and potential price appreciation, Arrived offers a compelling alternative for investors looking to diversify their real estate holdings and have more control over their investments.

The platform allows you to start small and gradually build your real estate portfolio over time. As you become more comfortable with the process, you can invest in multiple properties across different locations, further diversifying your real estate investments.

The bottom line? While becoming a landlord can be a lucrative way to generate passive income, it’s not the only option. REITs and platforms like Arrived offer investors the opportunity to earn rental income without the hassles of property management. These options provide accessibility to real estate investing for a wide range of investors, from those just starting out to experienced individuals looking to diversify their portfolios.

As with any investment, it’s essential to conduct thorough research and understand the risks involved before committing your hard-earned money. Consider your financial goals, risk tolerance, and investment horizon when choosing the right real estate investment strategy for you.

Ready to start earning passive rental income? View available properties on Arrived now and take your first step towards building your real estate portfolio without the landlord duties.

[/vc_column_text][vc_column_text tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”]

Investment Disclaimer: Not Investment Advice

Please Note: The content presented in this article is for informational purposes only and should not be considered as financial advice. While the information is based on sources believed to be reliable, the authors and publishers do not guarantee its accuracy or completeness.

Investments, especially in real estate, carry risks including the potential loss of principal. The past performance of Arrived or any other investment vehicle does not guarantee future results. Individual investment success may vary based on various factors including market conditions and personal financial situation.

We strongly advise readers to conduct their own research and consider consulting with a financial advisor or investment professional before making any investment decisions. A qualified advisor can provide personalized guidance tailored to your unique financial goals and risk tolerance.

By reading this article, you acknowledge that you are responsible for your own investment decisions and the authors and publishers of this content are not liable for any personal financial losses or gains.

[/vc_column_text][/vc_column][/vc_row][/tdc_zone]