[tdc_zone type=”tdc_content” tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImRpc3BsYXkiOiIifX0=”][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column_text]

Advertiser Disclosure: This article contains references to products from our partners. We may receive compensation when you click on links to those products. Our content is written objectively and is intended to provide informative and helpful information to our readers. Our goal is to help you make informed financial decisions, but our editorial integrity ensures our experts’ opinions aren’t influenced by compensation. Terms may apply to offers listed on this page.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column_text]

Warren Buffett Made Over $35.6 Million Per Day Last Year: Here’s How Everyday Investors Can Follow His Strategy

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_single_image media_size_image_height=”200″ media_size_image_width=”300″ image=”22699″ size=”100% auto” height=”600″][vc_column_text border_top=”no_border_top” tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”]

Image resembling Warren Buffett created with Midjourney AI

[/vc_column_text][/vc_column][/vc_row][vc_row tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImRpc3BsYXkiOiIifX0=”][vc_column tdc_css=”eyJhbGwiOnsiYm9yZGVyLXN0eWxlIjoibm9uZSIsImJvcmRlci1jb2xvciI6IiNmZmZmZmYiLCJzaGFkb3ctY29sb3IiOiIjZmZmZmZmIiwiZGlzcGxheSI6IiJ9fQ==”][vc_column_text border_top=”no_border_top”]

In the world of investing, few names command as much respect as Warren Buffett. The Oracle of Omaha’s net worth ballooned by an astonishing $13 billion in 2023, translating to an average gain of about $35.6 million per day. But what’s more remarkable is the simplicity and applicability of his investment strategies, strategies that can be mirrored by retail investors through platforms like Arrived.

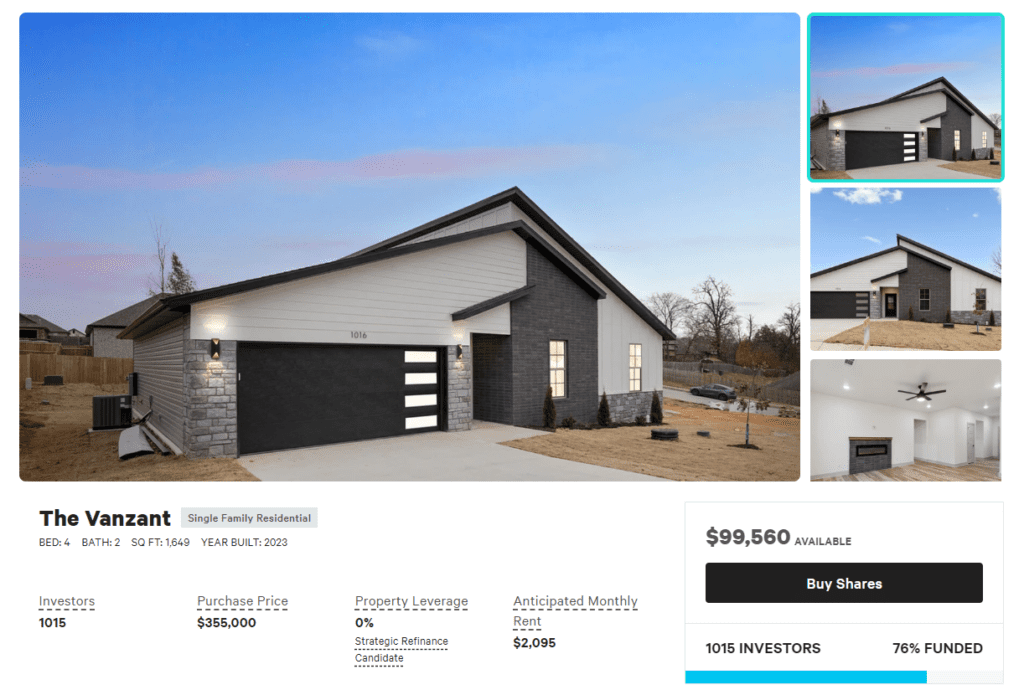

Arrived, a platform backed by Amazon.com founder Jeff Bezos, allows virtually anyone to invest in rental properties with as little as $100. Click here to see investment properties currently available.

Buffett’s Key Strategies: A Blueprint for Retail Investors

Buffett’s approach is grounded in seeking profitability and long-term value. In his 2019 shareholder letter, he outlined his criteria for investment: good returns on tangible capital, capable management, and sensible pricing. These principles are not just for elite investors; they’re applicable for anyone looking to grow their wealth, especially in the realm of real estate investment through platforms like Arrived.

1. The Principle of Safety: “Don’t Lose Money”

Buffett’s advice to “not lose money” emphasizes risk mitigation. In the world of real estate, this philosophy rings true. The demand for rental properties remains robust amidst a housing shortage, making investments in residential real estate a sound strategy. With Arrived, you can buy shares in rental properties for as little as $100, tapping into a market with enduring demand.

2. Contrarian Investing: Fear and Greed

Buffett advises being “fearful when others are greedy and greedy when others are fearful.” This wisdom is particularly pertinent in real estate. By investing in single-family rentals, you’re entering a market that’s not as volatile as the stock market, allowing for more stable, fear-free investments.

3. Productive Assets: Real Estate Over Speculation

Buffett’s preference for productive assets over speculative ones aligns perfectly with investing in rental properties. Unlike speculative assets, rental properties generate consistent cash flow. Arrived manages these properties, ensuring investors receive dividends from rental income while waiting for the property to appreciate in value.

4. The Index Fund Approach: Diversify with the Arrived Fund

Echoing Buffett’s advocacy for index funds, Arrived’s Single Family Residential Fund offers a similar opportunity in real estate. This fund allows investors to diversify across multiple properties, akin to an index fund’s spread across various stocks, but in the ever-growing real estate market.

Arrived: Your Gateway to Buffett-Esque Real Estate Investing

Arrived has funded more than 352 properties, with over $126 million in property value, demonstrating its credibility and success in the market. The platform simplifies the investment process, making it as easy as buying stocks through a brokerage app. One of its first properties, The Lierly, has already generated a total return of 136.1%, showcasing the potential of these investments.

In Q3 2023 alone, Arrived distributed $890k in dividends, highlighting the lucrative nature of this investment avenue. With more than 531,000 registered investors and the backing of high-profile investors like Jeff Bezos, Arrived stands as a testament to the power of strategic real estate investment.

Take Action Today

Inspired by Warren Buffett’s investment philosophy and looking to build your own portfolio of rental properties? Visit Arrived’s platform today and start with as little as $100. Embrace the wisdom of one of the greatest investors of our time, and let Arrived help you embark on your journey to financial growth and stability.

Click Here to Start Investing with Arrived

Image source: Image resembling Warren Buffett created with AI

Disclaimer: Not Investment Advice

Important Notice to Readers: The content of this article is for informational purposes only and does not constitute financial advice. The information provided is based on sources believed to be reliable and has been prepared in good faith. However, we make no representation or warranty, express or implied, regarding the accuracy, timeliness, or completeness of the information.

Investing in real estate and securities involves risks, including the potential loss of principal. The investment strategies and successes of Warren Buffett and other noted investors may not be suitable for all individuals. Each reader’s financial situation is unique, and investment decisions should reflect personal goals, risk tolerance, and financial needs.

We strongly advise that you consult with a licensed financial advisor or other qualified financial professional before making any investment decisions. A professional advisor can help you understand the risks and potential rewards of investment opportunities, tailor advice to your individual circumstances, and guide you in developing a sound investment strategy.

Remember, past performance is not indicative of future results, and investing always carries the risk of loss. By reading this article, you acknowledge and agree that neither the authors nor the publishers of this content are responsible for any financial decisions or losses you may incur as a result of acting on information found in this article.

[/vc_column_text][/vc_column][/vc_row][/tdc_zone]